Trading decisions influenced by stock market news

Stock market. Intro

The stock market is a complex and dynamic system that is influenced by a variety of factors, including economic indicators, political events, and company news.

One of the most significant drivers of stock market movements is news, which can have a profound impact on investor sentiment and trading decisions.

We will analyze how stock market news influences trading decisions, examine the behavioral biases that can affect investor behavior in response to news, and explore the role of technology in analyzing and responding to stock market news.

How stock market news influences trading decisions

Stock market news can take many forms, including earnings reports, economic indicators, and political events.

These types of news can have a significant impact on investor sentiment and trading decisions.

For example, when a company releases positive earnings news, investors may become more optimistic about the company's future prospects and buy more shares, driving up the stock price.

Similarly, when a political event such as an election or a trade agreement is announced, investors may adjust their portfolios based on their expectations for the impact of the event on the economy and individual companies.

The dissemination of news can also impact market volatility and investor sentiment.

For example, when news is disseminated quickly and widely, it can create a sense of urgency among investors, leading to increased volatility.

Conversely, when news is slow to be disseminated or is ambiguous, investors may become uncertain and hesitant to make trading decisions.

The role of media outlets and financial analysts in shaping market news is also significant, as they can influence how news is perceived and interpreted by investors.

Behavioral biases that can affect investor behavior in response to news

Behavioral biases, such as confirmation bias and herd mentality, can significantly impact investor behavior in response to stock market news.

Confirmation bias is the tendency to seek out information that confirms pre-existing beliefs, while her mentality is the tendency to follow the actions of others rather than making independent decisions.

These biases can lead investors to make irrational decisions based on incomplete or biased information.

Emotional responses, such as fear and greed, can also impact investor behavior in response to stock market news.

For example, when investors are fearful, they may sell off their holdings, driving down stock prices. Conversely, when investors are greedy, they may buy up stocks, driving up prices.

These emotional responses can create market bubbles and crashes, as investors make decisions based on their emotions rather than rational analysis. To mitigate these biases, investors can use strategies such as diversification, setting clear investment goals, and seeking out diverse sources of information.

Additionally, investors can use tools such as stop-loss orders and limit orders to manage risk and avoid emotional decision-making.

Explore the role of technology in analyzing and responding to stock market news

Technology has revolutionized the way investors analyze and respond to stock market news.

Tools and platforms such as news aggregators, social media, and real-time data feeds enable traders to access and analyze news quickly and efficiently.

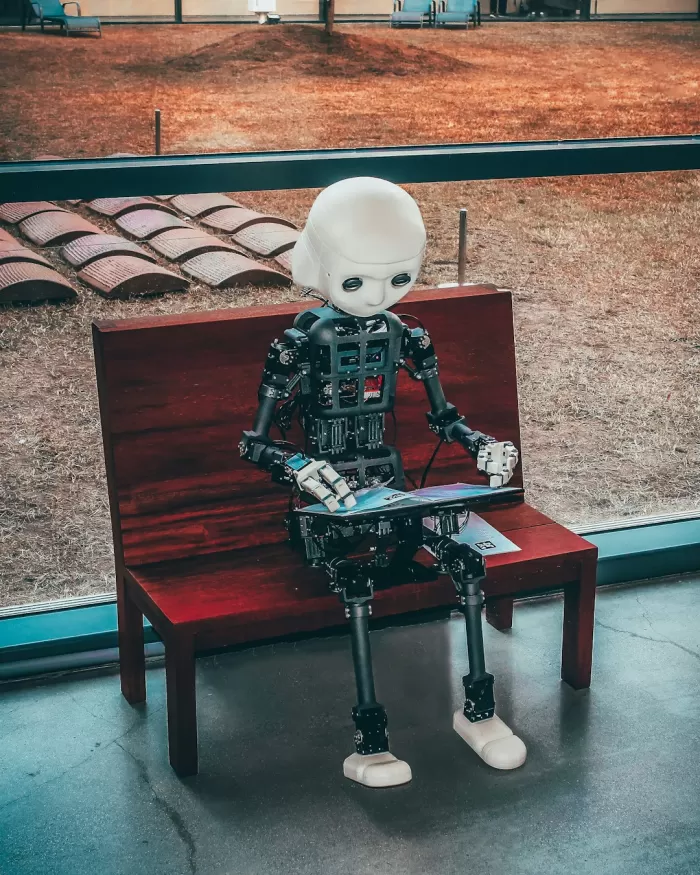

Algorithmic trading and artificial intelligence are also increasingly being used to analyze news and make trading decisions based on that analysis.

While these technological advancements offer many benefits, there are also ethical and regulatory considerations to be addressed.

For example, the use of algorithmic trading can create market instability and exacerbate market crashes.

Online money earning whatsapp group link